Key Drivers of the Housing Market

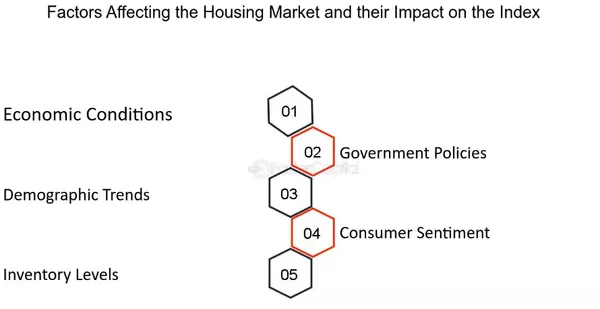

Key Drivers of the Housing Market and Their Impact on the S&P Case-Shiller Index Ever wonder why some homes soar in value while others plateau? The answer often lies in the hidden forces driving the housing market—factors that not only shape home prices but also influence broader trends tracked by the S&P Case-Shiller Index. Let’s break down how these key elements interact and what they mean for future real estate values. The housing market’s performance is influenced by several critical factors, each impacting the S&P Case-Shiller Index. From economic conditions and government regulations to demographic shifts and consumer confidence, understanding these drivers can provide insights into future market trends and help guide informed decisions. 1. Economic Conditions Economic health is one of the most significant factors shaping the housing market. Indicators such as GDP growth, employment rates, and interest rates play a major role in determining housing demand and supply. For instance, during periods of economic growth and low unemployment, demand for housing often increases, leading to rising prices and a positive influence on the index. Conversely, during economic downturns, reduced housing demand can lower prices, negatively impacting the index. 2. Government Policies Government policies, including taxation, lending standards, and zoning laws, heavily influence housing market dynamics. For example, tax incentives for first-time homebuyers or more accessible mortgage lending can stimulate demand and increase home prices, which positively impacts the index. On the other hand, tighter regulations or tax hikes can reduce affordability and cool the market, which may lead to a downturn in the index. 3. Demographic Shifts Changes in population growth, migration, and generational preferences also shape the housing market. For example, millennial demand for urban rental properties has driven up prices in city centers, impacting the index differently across regions. As generations like millennials delay homeownership or prefer multi-family housing, market demand shifts, influencing housing trends. 4. Consumer Confidence Consumer sentiment is a powerful factor in real estate. When people feel financially secure, they’re more likely to invest in home purchases, which drives up demand and prices. Alternatively, during times of economic uncertainty, consumer confidence can decrease, reducing demand and potentially lowering home values. Monitoring consumer sentiment can give a real-time view of housing demand trends. 5. Inventory Levels Housing supply relative to demand is a vital determinant of home prices. Limited inventory typically drives up prices, positively affecting the index, while an oversupply can decrease prices and negatively impact it. Inventory levels are shaped by factors like new construction, housing completions, and foreclosures, all of which serve as indicators of market conditions. Each of these factors—economic conditions, government policies, demographic trends, consumer confidence, and inventory—plays a role in shaping housing market performance and influencing the S&P Case-Shiller Index. However, economic health and government policy changes often have the most direct impact. By staying informed about these drivers, investors and analysts can better anticipate market movements and make strategic decisions in the evolving real estate landscape. Curious about how these factors might affect your buying or selling decisions? Reach out to explore current trends and understand how shifts in the market could impact your real estate plans! Available Downloads: How to Sell Your House In a Changing Market How to Buy a Home In Any Season https://primenorthwesthomes.com/

Market Update and Trends for Puget Sound Housing Market - June 2024. Aaron Miriello- Prime Northwest Homes, brokered by eXp Realty

Today we're going to talk about some crucial market updates and trends that are affecting the Puget Sound housing market. We will be reviewing June's data. I am Aaron Miriello, your host, joined by top agent in this area, serving both Greater Seattle and South Sound. 🏡 Market Recap In June 2024, most Washington counties recorded a major increase in inventory levels estimated at 35.7% year-over-year. 📈 Volumes, however, fell 3.1%, indicative of suppressed buying power, with buyers hesitant to commit to the market as mortgage rates wobbled between 6.8% and 7.1%. Buyers are either adjusting their price range, looking for different property conditions or locations, or taking a break from the market altogether, which is understandable given the circumstances. 📉 Key Takeaways from June 2024 Median Sales Price: The median price for homes and condos was $650,000, an increase of 4% from June 2023. 💵 In layman's terms, if you waited one year you just paid $26,000 more for the same house. Prices have increased with the limited supply and high demand, even with high mortgage rates. As more homes come into the market for sale, prices could stabilize—though strong demand and low affordability will keep them at high levels. If mortgage rates fall further, more buyers will come into the market, which should raise competition. Active Listings: Listings increased, showing a big seasonality effect of buying and selling as sellers try to cash in on high prices and equity gains. 📊 This is expected to carry through to 2025 with greater availability for buyers and pricing perhaps reined in somewhat as mortgage rates lose some luster. Closed Sales Transactions: Closed sales transactions, year-over-year, truly went in the wrong direction from April/May 2024 by decreasing 3.1%. 📉 This is a sure sign buyers are getting spooked at higher mortgage rates and affordability challenges. A cautious recovery in transaction volume is expected through 2025, influenced by economic conditions and political uncertainties, including the presidential election in November 2024. Months of Inventory: Currently at 2.17 months, indicating a seller's market. 🏘️ The lowest inventory is in Snohomish (1.37), Thurston (1.55), and Kitsap (1.60). The current inventory level shows high demand and relatively low supply. Active listings that are rising do reflect a move towards a balanced market by 2025, assuming steady economic conditions with only small rate drops. This balance would help to stabilize home prices while reducing extreme competition among buyers. Conclusion All of these data indicate a return toward normalization in the Puget Sound real estate market. There is increased inventory, which gives more choices for the buyer, but high mortgage rates still affect affordability. Yet Seattle metro home prices continue strong, and increasing inventory is expected to slow price pressures further over time. If there's a rate cut in September or October, that might extend opportunities for buyers. The real estate season starts to slow down around the second week in September. 📆 If you have any questions or need more insights, please get in touch. Let's walk through this market and bring out the best opportunities for you! 🤝 SEO Keywords: Puget Sound Housing Market Seattle Real Estate Trends 2024 Housing Market Update Washington Home Prices Seattle Property Listings Pierce County Real Estate King County Housing Inventory Seattle Home Buying Tips Puget Sound Real Estate Forecast Greater Seattle Real Estate Agent

Assessing Today's Market: Heating Up or Cooling Down?

Being an active real estate agent in the Purget Sound market, I've been witnessing a significant uptick in multiple offers on properties lately. The majortiy being in the King County area. The competition amongest buyers is heating up, making it crucial for prospective homeowners to structure their deals competitively to stand out in this fast-paced environment. In King County, for the hottest properties, buyers often conduct their own pre-inspections if the seller hasn't already done so. With many offers being cash offers, buyers can waive the finance and appraisal contingencies. Additionally, earnest money deposits of 5% to 10% are becoming common, and some buyers are even releasing earnest money to the sellers after a certain number of days, fully committing to the seller that "hey, yeah, we definitely want your home." The current trends in King County are expected to influence the Pierce County area in the next few months, typically with a lag of 5-8 weeks. This lag provides residents of Pierce County with a valuable heads-up. 1) Get Pre-Approved: Before starting your home search, get pre-approved for a mortgage. This not only demonstrates to sellers that you're a serious buyer but also gives you a clear idea of your budget, helping you make more competitive offers. 2) Work with a Realtor: Partnering with an experienced realtor who knows the local market inside and out is invaluable. They can provide valuable insights, guide you through the negotiation process, and help you craft a compelling offer that stands out to sellers. 3) Act Quickly: In a hot market, time is of the essence. Be prepared to act quickly when you find a property that meets your criteria. Delaying even for a day could mean losing out on the opportunity. 4) Be Flexible: Flexibility is key when navigating a competitive market. Consider being flexible with your offer terms, such as the closing date or contingencies, to make your offer more appealing to sellers. 5) Offer a Competitive Price: While it's essential to stick to your budget, offering a competitive price is crucial in a multiple offer situation. Work closely with your realtor to determine the fair market value of the property and craft an offer that reflects its worth. By following these tips and working closely with a trusted realtor, buyers can position themselves for success in King County's competitive real estate market. And remember, what we're seeing here today will likely impact the Pierce County area tomorrow, so being proactive is key.

Categories

- All Blogs (45)

- Agent (3)

- Appraisal (1)

- Buyers (8)

- Escrow (1)

- FHA (2)

- Financing (1)

- First time homebuyer (1)

- Home Buying Criteria (1)

- Homeowners (1)

- Loans (2)

- Market Conditions (3)

- Multiple Offers (2)

- NAR (1)

- Negotiation (2)

- Offers (2)

- School Districts (1)

- Sellers (8)

- Selling (15)

- Staging (3)

- Tips (3)

- Title (1)

- Utilities (4)

- Videos (1)

Recent Posts