Key Drivers of the Housing Market

Key Drivers of the Housing Market and Their Impact on the S&P Case-Shiller Index

Ever wonder why some homes soar in value while others plateau? The answer often lies in the hidden forces driving the housing market—factors that not only shape home prices but also influence broader trends tracked by the S&P Case-Shiller Index. Let’s break down how these key elements interact and what they mean for future real estate values.

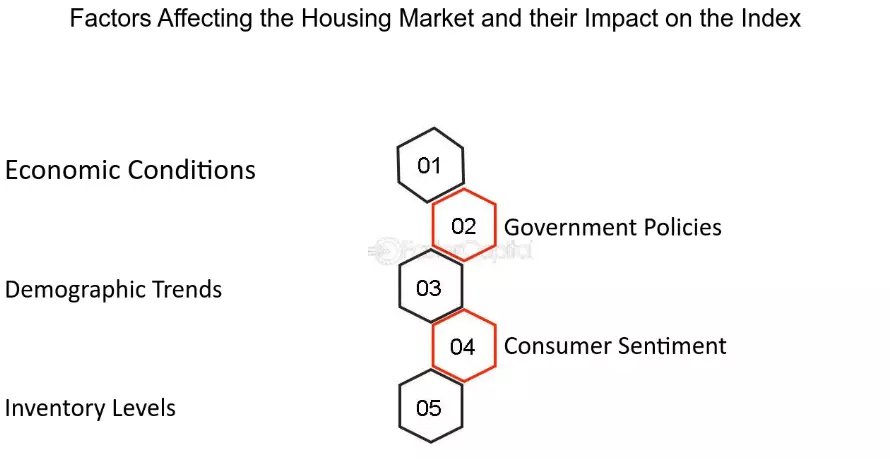

The housing market’s performance is influenced by several critical factors, each impacting the S&P Case-Shiller Index. From economic conditions and government regulations to demographic shifts and consumer confidence, understanding these drivers can provide insights into future market trends and help guide informed decisions.

1. Economic Conditions

Economic health is one of the most significant factors shaping the housing market. Indicators such as GDP growth, employment rates, and interest rates play a major role in determining housing demand and supply. For instance, during periods of economic growth and low unemployment, demand for housing often increases, leading to rising prices and a positive influence on the index. Conversely, during economic downturns, reduced housing demand can lower prices, negatively impacting the index.

2. Government Policies

Government policies, including taxation, lending standards, and zoning laws, heavily influence housing market dynamics. For example, tax incentives for first-time homebuyers or more accessible mortgage lending can stimulate demand and increase home prices, which positively impacts the index. On the other hand, tighter regulations or tax hikes can reduce affordability and cool the market, which may lead to a downturn in the index.

3. Demographic Shifts

Changes in population growth, migration, and generational preferences also shape the housing market. For example, millennial demand for urban rental properties has driven up prices in city centers, impacting the index differently across regions. As generations like millennials delay homeownership or prefer multi-family housing, market demand shifts, influencing housing trends.

4. Consumer Confidence

Consumer sentiment is a powerful factor in real estate. When people feel financially secure, they’re more likely to invest in home purchases, which drives up demand and prices. Alternatively, during times of economic uncertainty, consumer confidence can decrease, reducing demand and potentially lowering home values. Monitoring consumer sentiment can give a real-time view of housing demand trends.

5. Inventory Levels

Housing supply relative to demand is a vital determinant of home prices. Limited inventory typically drives up prices, positively affecting the index, while an oversupply can decrease prices and negatively impact it. Inventory levels are shaped by factors like new construction, housing completions, and foreclosures, all of which serve as indicators of market conditions.

Each of these factors—economic conditions, government policies, demographic trends, consumer confidence, and inventory—plays a role in shaping housing market performance and influencing the S&P Case-Shiller Index. However, economic health and government policy changes often have the most direct impact. By staying informed about these drivers, investors and analysts can better anticipate market movements and make strategic decisions in the evolving real estate landscape.

Available Downloads:

How to Sell Your House In a Changing Market

How to Buy a Home In Any Season

https://primenorthwesthomes.com/

Categories

- All Blogs (80)

- Agent (3)

- Appraisal (1)

- Buyers (23)

- Educational (4)

- Escrow (1)

- FHA (3)

- Financing (4)

- First time homebuyer (6)

- Home Buying Criteria (3)

- Homeowners (6)

- Loans (2)

- Market Conditions (19)

- Miscellaneous (4)

- Multiple Offers (2)

- NAR (1)

- Negotiation (2)

- Offers (2)

- School Districts (1)

- Sellers (28)

- Selling (32)

- Staging (3)

- Tips (11)

- Title (1)

- Utilities (4)

- Videos (1)

Recent Posts

GET MORE INFORMATION