Understanding the Escrow Process: A Step-by-Step Guide

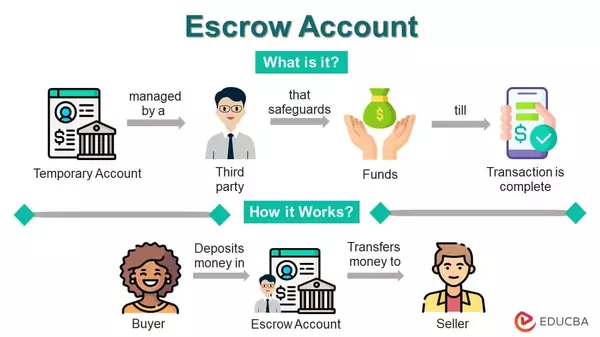

Escrow Process Overview An escrow is a vital part of either the home buying or selling process. It helps assure each party that the other lives up to their end of the bargain before the transaction is finalized. Here's a more in-depth look at the escrow process, why it matters, and what to expe

Categories

- All Blogs (79)

- Agent (3)

- Appraisal (1)

- Buyers (22)

- Educational (4)

- Escrow (1)

- FHA (3)

- Financing (4)

- First time homebuyer (6)

- Home Buying Criteria (3)

- Homeowners (6)

- Loans (2)

- Market Conditions (18)

- Miscellaneous (4)

- Multiple Offers (2)

- NAR (1)

- Negotiation (2)

- Offers (2)

- School Districts (1)

- Sellers (27)

- Selling (31)

- Staging (3)

- Tips (11)

- Title (1)

- Utilities (4)

- Videos (1)

Recent Posts

Seattle’s Relocation Reality Check: Where Are Buyers Really Going in 2025?

View Homes in the PNW: What’s Worth the Price and Where to Find It in 2025

What Smart Buyers & Sellers Should Know

The Biggest Mistakes Sellers Make in a High-Inventory Market (and How to Avoid Them)

Washington’s Housing Construction Reforms: A Bold Step Toward Affordability

How to Sell Your Home in a Crowded Market Without Sacrificing Your Net

April 2025 Puget Sound Real Estate Market Report

Barndominiums: Escape the City and Embrace a New Way of Living

Why Sellers Should Get a Pre-Listing Home Inspection | Maximize Value & Avoid Surprises

5 Home Repairs You Should Skip Before Selling